- Pip Munch

- Posts

- 📉 Trump Attacks Powell, Stocks Crash

📉 Trump Attacks Powell, Stocks Crash

Tired of waiting weeks for your payout?

Lark Funding gets you paid fast. Under 6 hours, on average. No delays. No fluff. Just raw spreads, fast payouts, and up to 90% splits.

☕️ GM Munchers! Sorry for ghosting you yesterday — turns out eating 14 mini eggs per hour has consequences.

On today’s menu:

📉 Trump Attacks Powell, Stocks Crash

🚀 Gold Goes Parabolic

🤔 Is Bitcoin Telling Us Something?

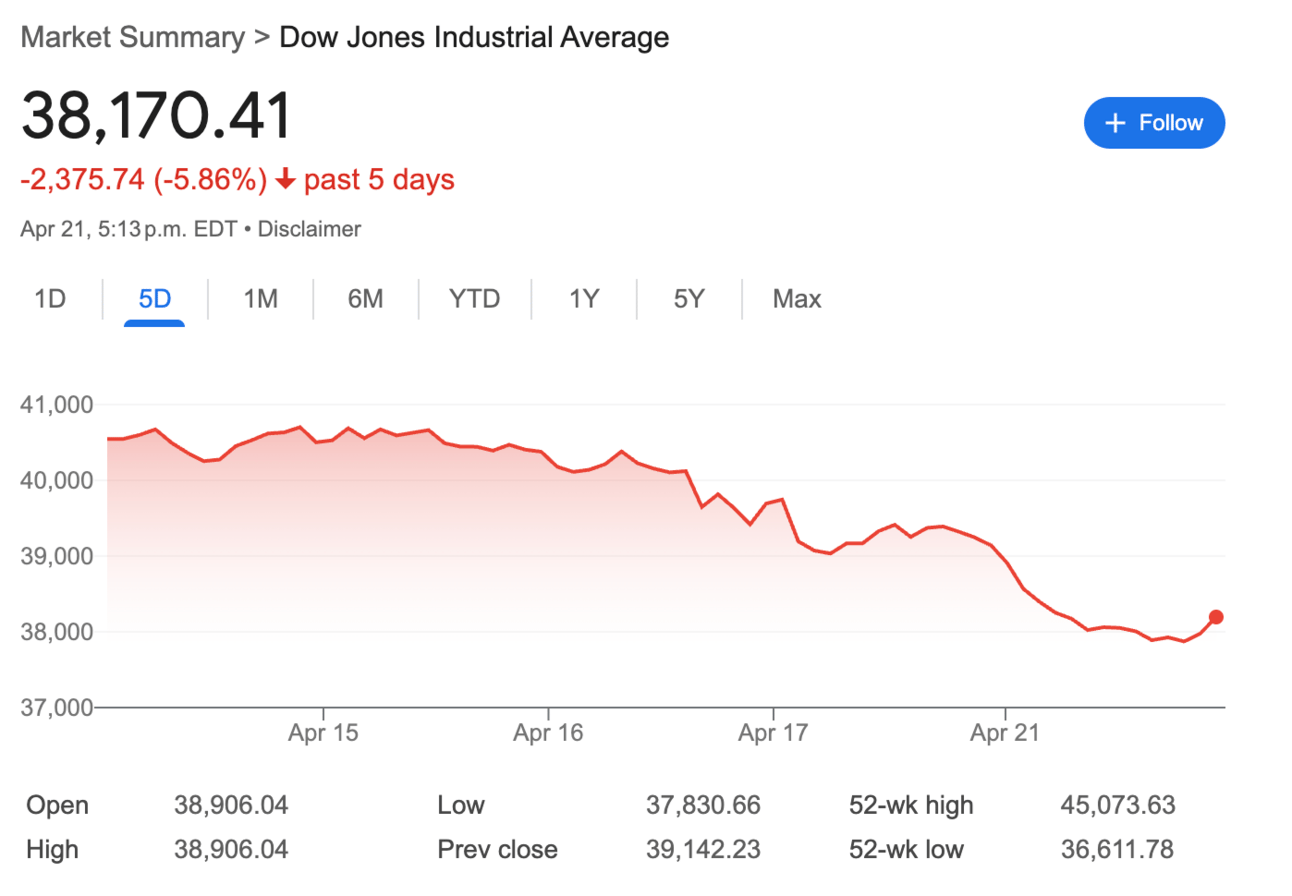

🤯 The Dow Jones is on track for its worst April since 1932

🇨🇳 China Is Doubling Down

BREAKING NEWS

📉 Trump Attacks Powell, Stocks Crash

The market was so ugly yesterday, even my Meta stock stopped showing me ads and just asked if I was okay.

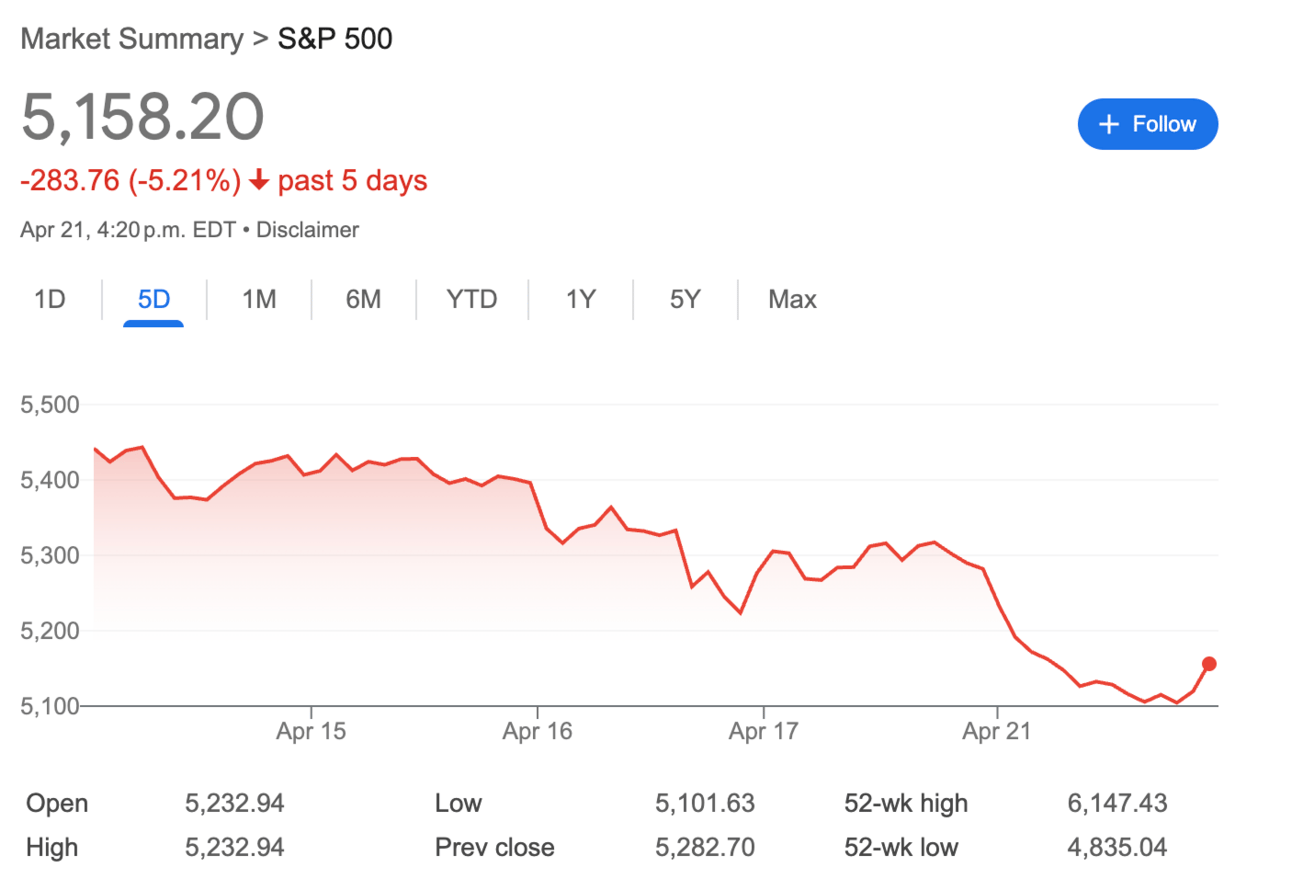

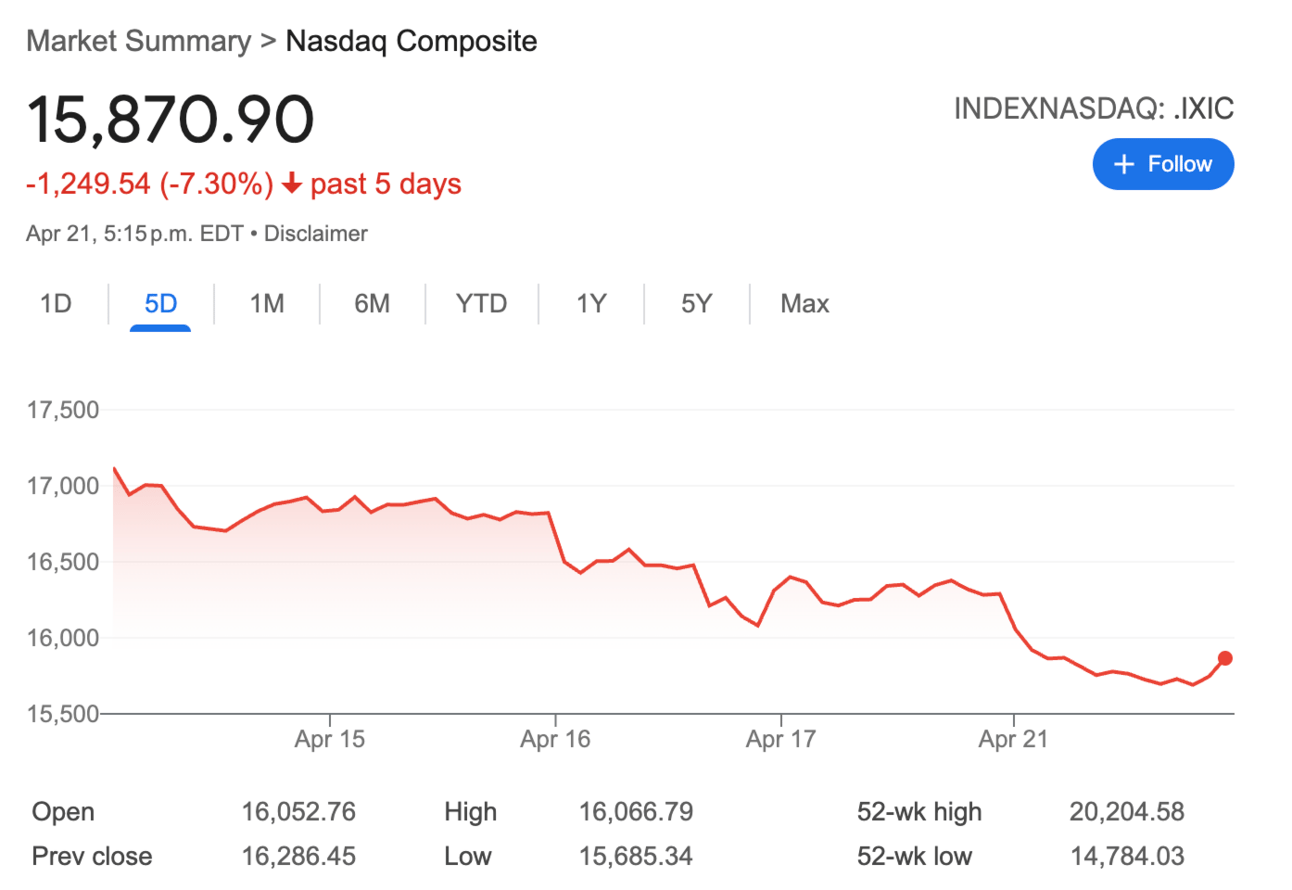

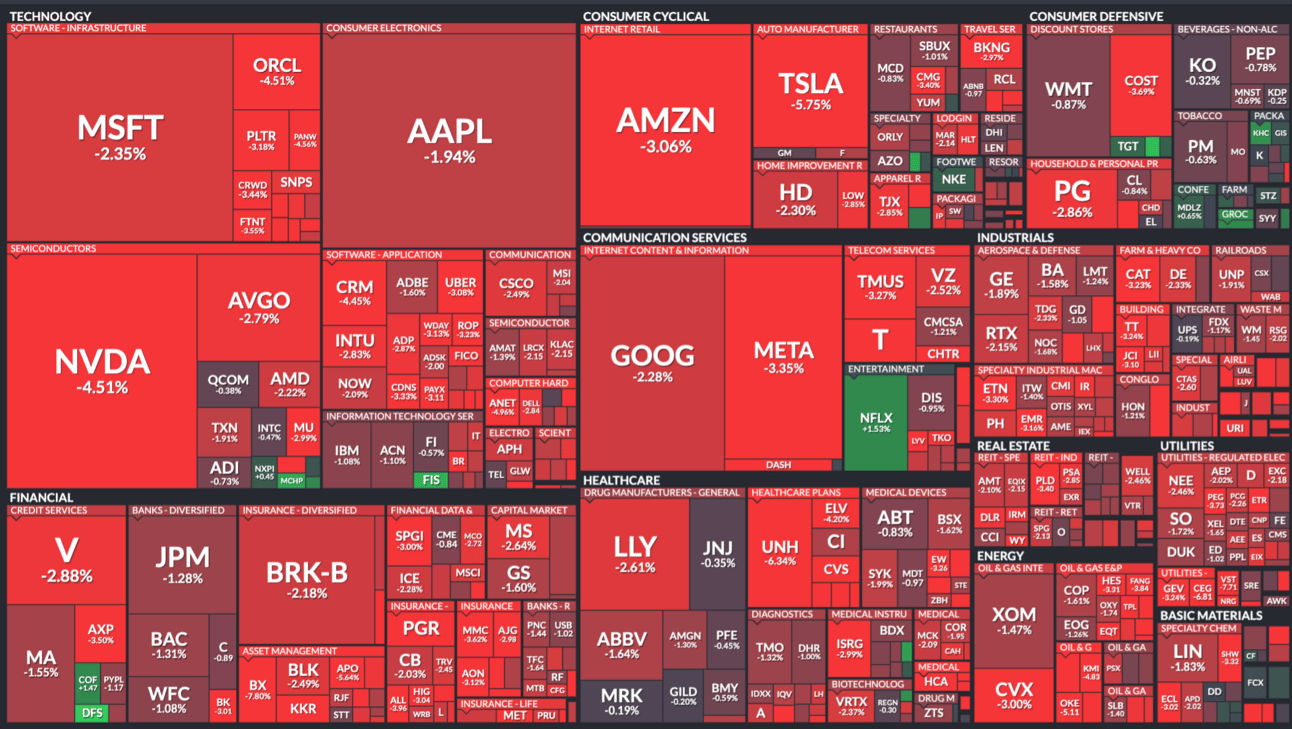

All three major indices were a sea of red:

S&P 500: -2.7%

Dow Jones: -2.0%

Nasdaq: -2.6%

And the cause? Let’s just say the vibes were not immaculate.

Donald Trump took to Truth Social to call Fed Chair Jerome Powell a “major loser” (again), demanded “preemptive cuts” in interest rates, and hinted that Powell’s termination cannot come fast enough.

Traders didn’t take that well.

In fact, the market shed $750 billion in market cap shortly after the rant.

He argued there’s “virtually no inflation” and claimed energy and food prices are trending down.

But rather than calming things down, this only added fuel to the fire.

Why?

Because it’s one thing to call for rate cuts — it’s another to threaten the Fed’s independence.

Evercore ISI’s Krishna Guha warned that even raising questions about Powell’s job could cause “a severe reaction in markets.”

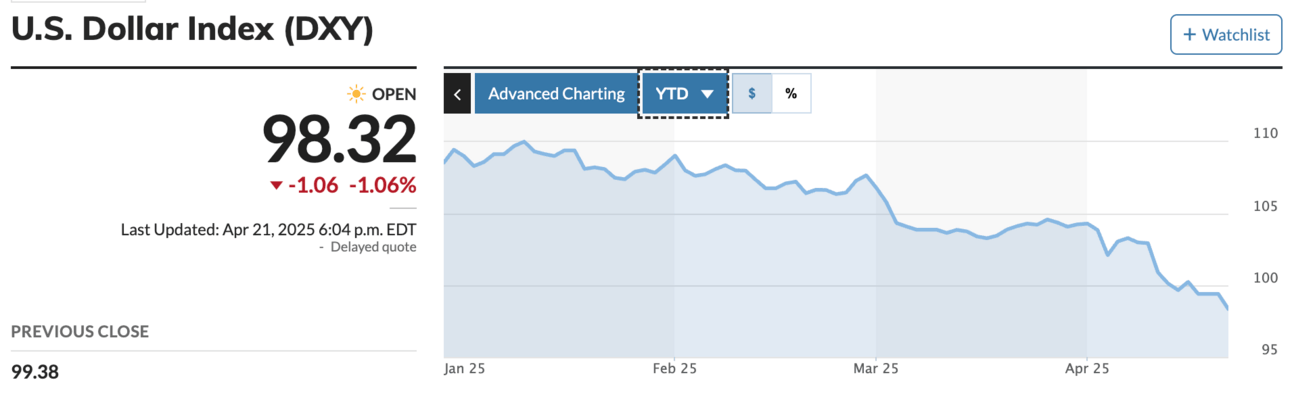

And right on cue, the US dollar dropped 1.06%, its lowest level since 2022.

The selloff in the dollar is telling. In a typical panic, the USD rallies.

During COVID? The dollar soared.

But yesterday, traders dumped the dollar and rushed to real assets.

Which brings us to…

BROUGHT TO YOU BY

The Fastest Payouts In The Industry—Since 2022

Since 2022, Lark Funding has built a reputation on one thing: speed.

They process payouts in under 6 hours on average—even on weekends. No long waits. No excuses.

Choose from 1-step, 2-step, 3-step, or Instant challenges. Up to $600K funding. 90% splits.

When you’re ready to trade fast, scale fast, and get paid fast—there’s only one prop firm to call.

COMMODITIES

🚀 Gold Goes Parabolic

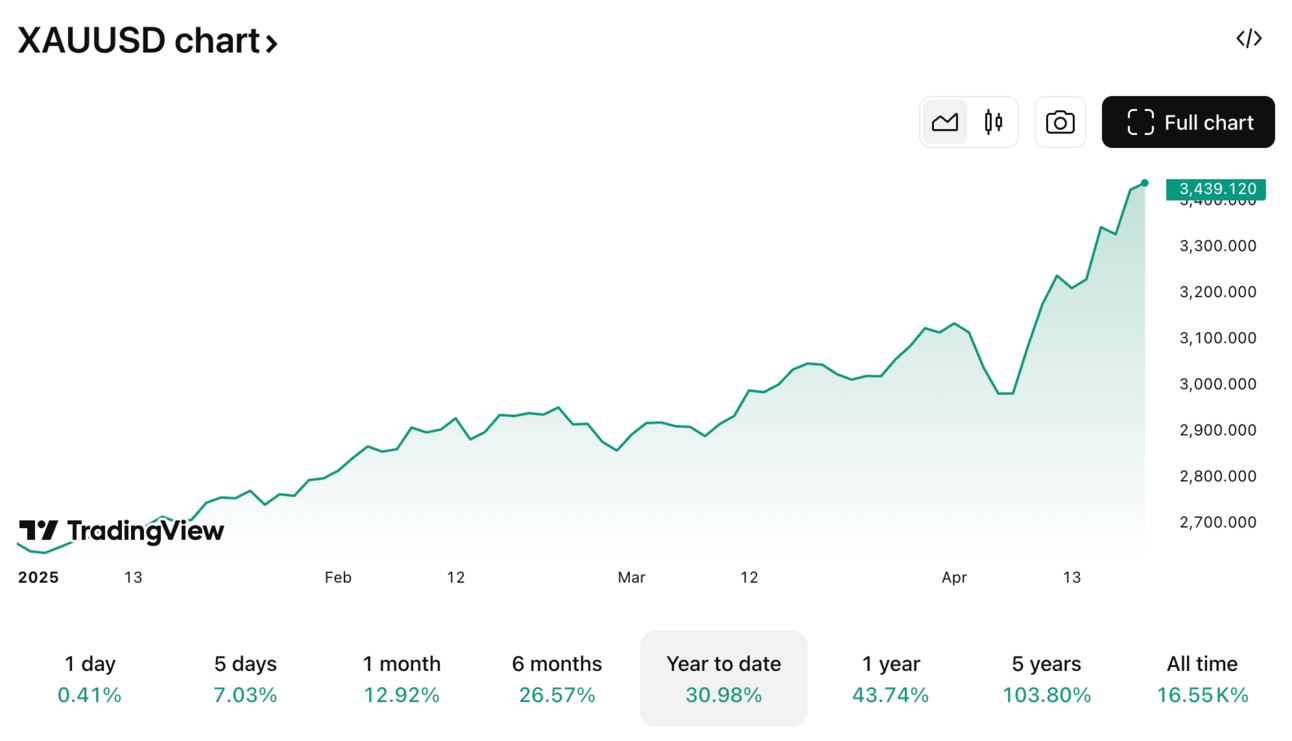

Gold didn’t just shine yesterday. It straight-up exploded:

Gold closed up $93 to $3,420

That’s a record high

Peter Schiff (who’s been calling for this since Moses parted the sea) said this spike is a “clear market signal” that the Fed should be hiking, not cutting. But markets believe Powell will cave to political pressure.

And if that happens? Schiff says gold will go “soaring.”

Gold jumping above $3,400 is a clear market signal that the Fed needs to raise interest rates. Yet everyone, including Trump, is calling for the Fed to cut them. The Fed will likely ignore gold's warning and cave to the pressure to cut. That policy mistake will send gold soaring.

— Peter Schiff (@PeterSchiff)

1:33 PM • Apr 21, 2025

Here’s why this matters for traders:

Rate cut pressure + USD selloff = Gold rocket fuel

When real rates fall and the dollar weakens, gold doesn’t just benefit — it thrives. Add political chaos and inflation uncertainty, and you’ve got a recipe for moon dust.Safe haven? Yes. But this is also about trust.

This isn’t just people playing defense — this is a major vote of no confidence in monetary policy.

Gold’s breakout tells us something bigger: investors no longer trust the Fed to stay objective.

If that continues, this won’t be the last time gold makes headlines. It’ll be the start of a trend.

2025 Performance:

S&P 500: -12.5%

Gold: +30%— Brew Markets (@brewmarkets)

4:44 PM • Apr 21, 2025

STOCKS

🤔 Is Bitcoin Telling Us Something?

While stocks puked and the dollar slid, Bitcoin has been quietly crushing it, closing above $87,000.

Let’s put this in perspective:

S&P 500: -7% (since Trump’s tariff announcement)

Nasdaq: -8%

QQQ: -9%

BTC: +4%

That’s what traders call a decoupling.

DECOUPLING

BTC +4%

S&P -7%

Nasdaq -8%

QQQ -9%— Mitchell ✝️🇺🇸 (@MitchellHODL)

2:37 PM • Apr 21, 2025

Normally, when equities crash, BTC crashes harder. But not this time. Bitcoin is doing the unthinkable: rising while both stocks and the US dollar fall.

Why is that so rare?

Because usually when stocks collapse, the dollar rallies as investors run to safety.

That’s what happened during COVID. That’s what happened in 2008. The USD becomes the life raft.

But yesterday, the dollar dropped. Gold soared. And Bitcoin? It’s moving like a macro hedge — not a tech stock.

That’s a huge shift.

Global Investors are losing confidence in the U.S.

— Brew Markets (@brewmarkets)

8:29 PM • Apr 21, 2025

For the first time in a long time, Bitcoin is trading like what its fans always claimed it was: a hedge against chaos, not a levered bet on tech.

If this sentiment sticks, we might be entering a new regime. One where Bitcoin moves opposite the dollar — not with it.

And in that world, pairing BTC with macro trends might not just be meme-fuel. It might actually work.

PROP FIRMS

🤑 Tuesday Motivation

Trader requested a payout on Easter Sunday and got paid in under an hour.

No delays. No excuses. Just speed.

This is why we’re known for the fastest payouts in the industry.

Ready to join them?

📸 Proof below 👇

— larkfunding (@larkfunding)

3:10 PM • Apr 21, 2025

🚀 Pre-Market Fuel

🍪 Munchy Memes

Me after 3 months of Trumps golden age

— Wall Street Memes (@wallstmemes)

12:23 PM • Apr 18, 2025

Investment banking analysts after paying 75% of their salary in NYC rent and taxes

— Boring_Business (@BoringBiz_)

6:30 PM • Apr 18, 2025

“Nobody is an atheist at 50x leverage” is one of the greatest things ever written on this app

— Zack Voell (@zackvoell)

2:32 PM • Apr 20, 2025

What do you think of today's edition? |

Share Pip Munch

Chances are you have some trading friends. Why don’t you be a pal, share Pip Munch and earn some goodies for it?

You currently have 0 referrals, only 1 away from receiving The Trading Plan That Helped Me Pass 4 $100,000 FTMO Challenges.

Or copy and paste this link to others: https://pipmunch.com/subscribe?ref=PLACEHOLDER