- Pip Munch

- Posts

- 📉 Trump's Tariff Tantrum

📉 Trump's Tariff Tantrum

Still waiting days for your payout? That’s adorable. At Lark Funding, traders cash out in under 6 hours — no red tape, no excuses. Just clean spreads, lightning-fast payouts, and up to 90% profit splits.

☕️ GM Munchers! Turns out, Trump’s next trade war is with… Hollywood? Get ready for Fast & Furious 15: Tariff Drift.

On today’s menu:

📉 Trump's Tariff Tantrum

🤔 Is Instant Funding Worth It?

🇺🇲 Dollar's Dance of Despair: A 2025 FX Tragedy

🏛️ Stock Market Drama: Three Names Moving Markets Today

🚀 MicroStrategy Buys More Bitcoin

Yesterday’s numbers:

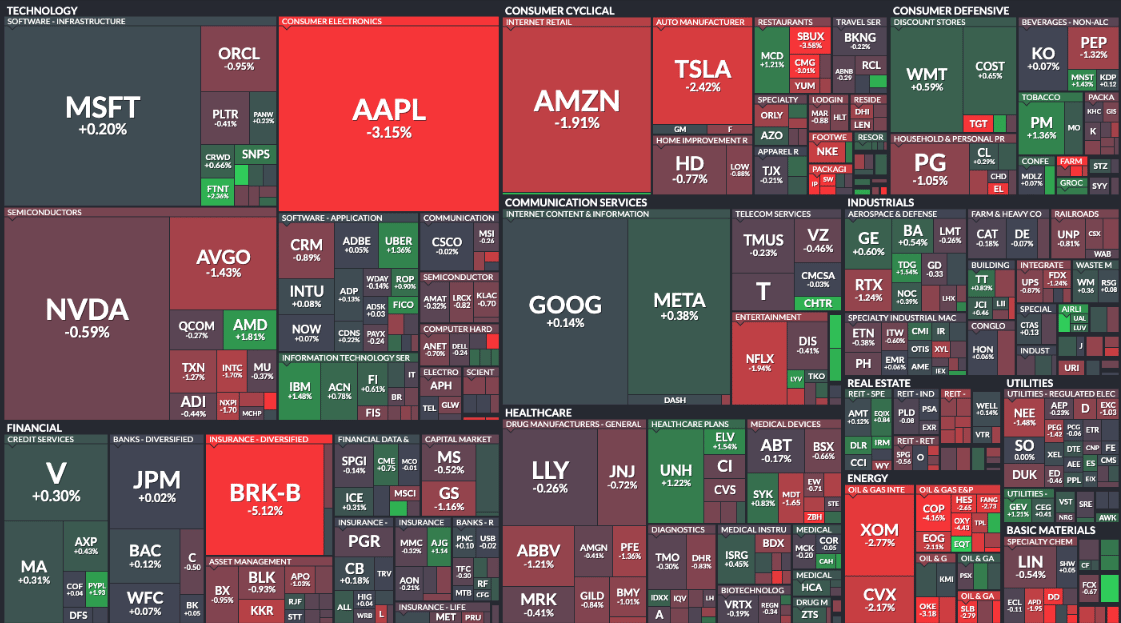

S&P 500 | 5,650 | -0.64% |

Nasdaq | 17,844 | -0.74% |

Dow Jones | 41,218 | -0.24% |

Bitcoin | $94,929 | +0.43% |

BREAKING NEWS

📉 Trump's Tariff Tantrum

Well, folks, Wall Street's party just got crashed harder than a wedding reception when the ex shows up.

Trump's latest tariff tirade—slapping a jaw-dropping 100% tax on foreign films with pharmaceuticals next on the chopping block—sent markets into a tailspin faster than you can say "trade war."

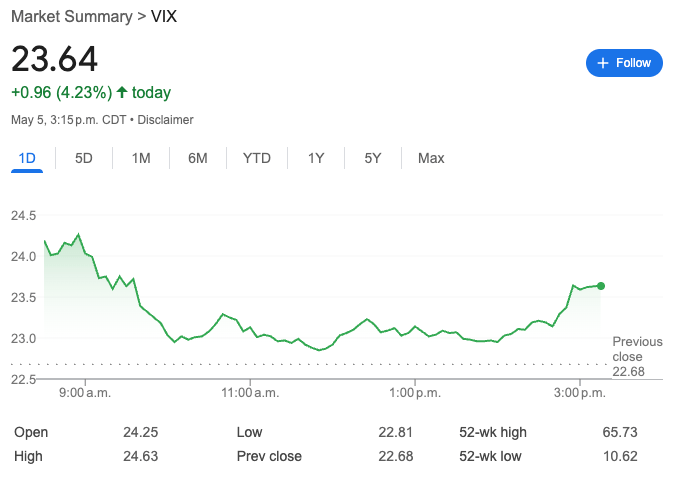

The VIX—our beloved "fear gauge"—jumped a stomach-churning 4% today, essentially the financial equivalent of your doctor saying "hmm, that's interesting" during a routine checkup.

Never a good sign.

Meanwhile, the S&P 500's impressive nine-day winning streak (a market unicorn not seen in two decades) finally collapsed like a soufflé in a slam contest, dropping 0.64%.

Where Does That Leave Traders? 🤔

It puts us in yet another “wait and see” environment.

For markets to rally with conviction, traders need economic visibility clearer than a windshield after a premium carwash. Instead, we're squinting through mud-splattered uncertainty:

Is Trump serious about tariffs, or is it all one big negotiation tactic?

The USD has been crashing (more on that below). Is that temporary, or are we beginning to see a global shift of it losing it’s safe-haven status?

When will the Fed cut rates? And by how much?

This murky outlook has charts moving sideways like a drunk crab on a beach.

Our battle-tested recommendation? When the macro picture resembles abstract art, drop to lower timeframes and trade what's actually in front of you. The quickest path to an empty account is forcing trades that simply aren't there. Remember: patience isn't just a virtue—it's a profit strategy.

BROUGHT TO YOU BY

🤔 Is Instant Funding Worth It?

We all know by now (at least you should) that the smartest way to scale in trading is with prop firms.

Pass a challenge, get access to larger capital, and keep 80–90% of your profits.

But… what if you could skip the challenge entirely?

What if you could start earning today — no hoops, no waiting?

With Lark Funding’s Instant Funding accounts, that’s exactly what you get:

✅ 8% Max Drawdown

✅ No Consistency Rules

✅ No Minimum Trading Days

✅ No News Restrictions

✅ Up To 90% Rewards

No gimmicks. No fake promises. Just raw, immediate trading power.

👉 Ready to skip the wait? Use code MAY10 for 10% off at larkfunding.com

STOCKS

🏛️ Stock Market Drama: Three Names Moving Markets Today

If you thought your Monday morning was rough, check out what happened to these stock market darlings. The trading day was about as stable as my diet after discovering Trader Joe's now sells cookie butter by the gallon.

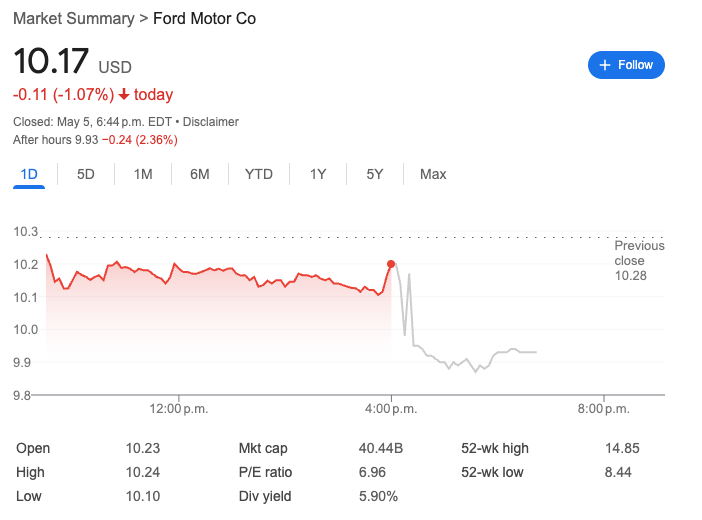

🚗 Ford Hits the Brakes

Ford (F) shares skidded ~1% after the automaker suspended its 2025 guidance faster than I abandon my New Year's resolutions.

The culprit? A massive $2.5 billion expected hit from new tariffs.

Traders reacted like someone unplugged the DJ at a wedding – not because the news was terrible, but because suspended guidance creates uncertainty. And the market hates uncertainty more than I hate people who don't use turn signals.

Ford now sits in the danger zone for further headline risk on trade policies. If you're holding F shares, maybe keep that seatbelt fastened. And don’t look at the 5-year chart which is completely flat…

🤖 Palantir's AI Glow-Up

Meanwhile, Palantir (PLTR) popped after raising its full-year guidance, with CEO Alex Karp describing a "tectonic shift" in AI adoption.

Traders are piling in faster than I attack a free buffet – not just on fundamentals, but because AI momentum has been hotter than my laptop after running TradingView all day.

Word of caution: Watch for profit-taking risk here. Stocks that surge on guidance hikes sometimes retrace faster than my hairline in my 30s.

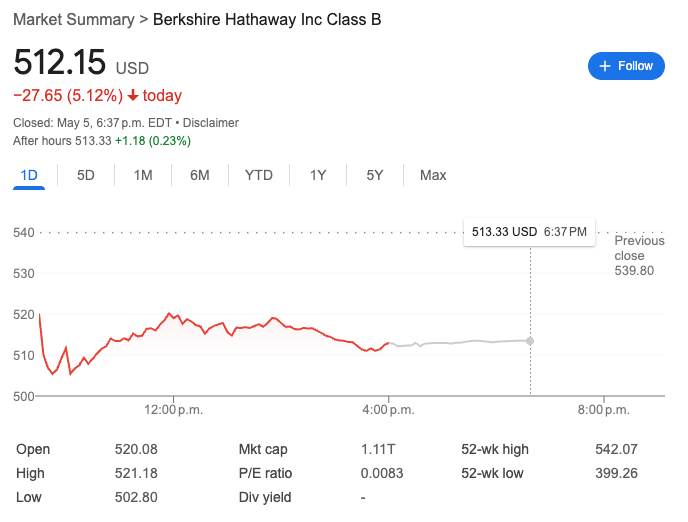

🧙♀️ Buffett's Magic Touch Fades

Berkshire Hathaway (BRK.B) tumbled over 5% after Warren Buffett announced he's stepping down as CEO, paired with an earnings decline.

Even though Greg Abel was the expected successor, the shock of Buffett's official transition extracted what insiders call the "Buffett premium" – which is like the opposite of the premium I pay for guacamole at Chipotle.

Smart traders are watching whether Berkshire stabilizes or if more outflows follow from funds adjusting their "old guy we trust" allocations.

FOREX

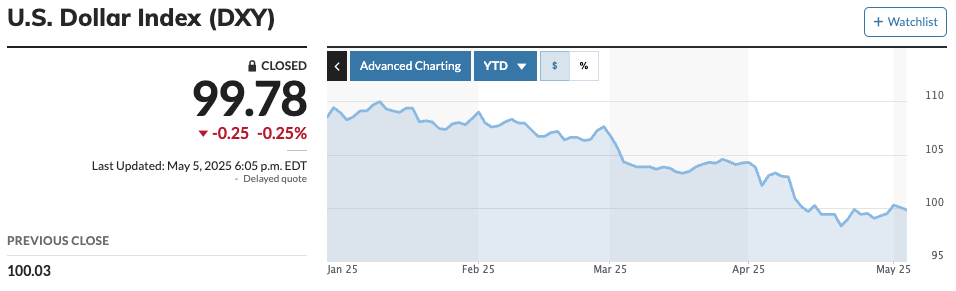

🇺🇲 Dollar's Dance of Despair: A 2025 FX Tragedy

Folks, it’s time for an update on the mighty Dollar which has been acting like a heavyweight boxer past his prime.

Yesterday’s session?

Another masterclass in disappointment. ❌

The dollar retreated faster than politicians from campaign promises, despite global tensions that should have investors flocking to it like seagulls to abandoned french fries.

The plot twist? This isn’t just about having one or two bad days—it's part of a bigger shift that’s taking place globally that could either make or break a traders year.

In short, The USD has transformed from a safe-haven superstar to a portfolio pariah, becoming 2025's financial equivalent of a participation trophy.

What’s going on?

The Fed's frozen rate policy has left the dollar in complete limbo

Europe and Japan’s currencies are strutting around with resilience nobody predicted

Trump's tariff tantrum has traders rotating away faster than carnival rides

Trading 101: Everybody flocks to the US Dollar during times of uncertainty. But we’re not seeing that right now, and it raises just one question:

Is all of this temporary, and will the USD remain the king of safe havens? Or are we witnessing a shift in global dynamics? 🤔

🚀 Pre-Market Fuel

🍪 Munchy Memes

Mf’ers be having this setup to monitor $40 worth of Eth

— Not Jerome Powell (@alifarhat79)

10:50 PM • May 5, 2025

What do you think of today's edition? |

Share Pip Munch

Chances are you have some trading friends. Why don’t you be a pal, share Pip Munch and earn some goodies for it?

You currently have 0 referrals, only 1 away from receiving The Trading Plan That Helped Me Pass 4 $100,000 FTMO Challenges.

Or copy and paste this link to others: https://pipmunch.com/subscribe?ref=PLACEHOLDER