- Pip Munch

- Posts

- 😬 Trump's Warning

😬 Trump's Warning

Traders love chocolate—but they love free accounts more.

Lark Funding’s Easter Hunt starts now. Free accounts. Big discounts. New surprise every day.

🐰 Happy Easter, Munchers! Markets are shut for Easter Friday, so go ahead and pretend you’re unplugging for spiritual reasons — not because Powell already wrecked your week.

On today’s menu:

😬 Trump’s Warning

🇯🇵 Japan’s Inflation Is Out of Control

🚀 Netflix Crushes

👀 Bill Ackman Invests In Hertz

📉 The US Dollar Is Hurting

BREAKING NEWS

😬 Trump’s Warning

If Powell was hoping for a quiet long weekend, he’s out of luck—because Trump is back on the timeline with more heat than CPI.

In a fiery post on Truth Social, Trump slammed Fed Chair Jerome Powell for being “TOO LATE AND WRONG,” arguing Powell should’ve already cut rates like the European Central Bank (ECB), which just lowered rates for the 7th time.

Trump went full send, calling Powell’s latest comments “another, and typical, complete mess,” and even floated the idea of Powell’s termination. (Just a casual Friday for democracy.)

“Powell’s termination cannot come fast enough!” – Donald Trump, professional central bank hater

Here’s the backstory: The ECB cut rates again, signaling concern about downside risks.

Lagarde removed the usual line about being in “restrictive territory” and said they’re open to a June cut.

The market now sees a 75% chance of that happening.

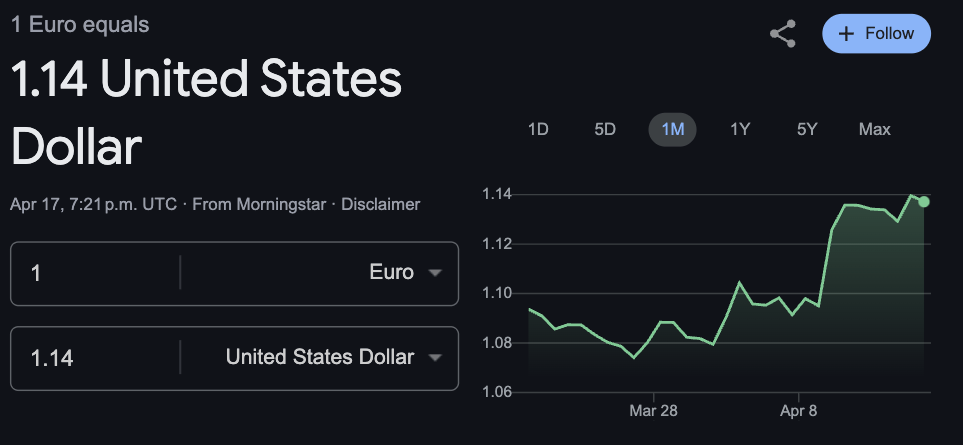

That news sent the euro down to 1.1335 before reversing as the U.S. dollar weakened.

Meanwhile, Powell had just given a speech a day earlier at the Economic Club of Chicago, warning that Trump’s tariffs could drive up inflation and slow down growth, putting the Fed’s dual mandate in conflict.

“We may find ourselves in a challenging scenario in which our dual-mandate goals are in tension.” – Powell, channeling his inner economic weatherman

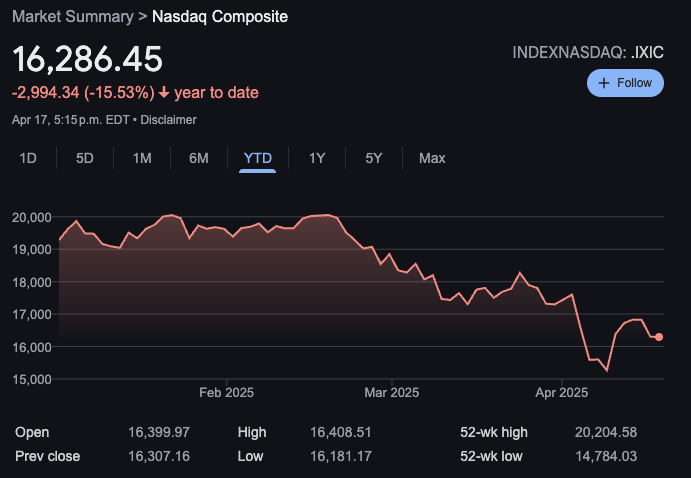

The S&P 500 managed to squeak out a 0.1% gain Thursday, but the Dow dropped 1.3% and the Nasdaq slipped 0.1%.

All three indexes still closed the week in the red, as traders tried to decode whether Powell was being cautious, clueless, or just trying to make it to his May 2026 retirement in peace.

BROUGHT TO YOU BY

Win A Free Prop Firm Challenge

🐣 The Lark Funding Easter Hunt Starts Today 🐣

We’re kicking off a 4-day Easter giveaway and Day 1 is wild: 10 traders will snag a $5K 3-Step Challenge account for FREE—no strings attached.

Here’s the catch:

The 100% off code is hidden somewhere on larkfunding.com.

Only the first 10 people who find it and redeem it win.

✅ 3-Step challenge

✅ No daily loss limit

✅ Reset discount if you mess up

Click on their website and join their email list so you don’t miss out on the daily fun..

Start the hunt now → larkfunding.com

FOREX

🇯🇵 Japan’s Inflation Is Out of Control

While Powell’s fighting Trump in the West, Japan’s dealing with a different beast: inflation that just won’t quit.

Headline inflation in Japan came in at 3.6% in March—marking the third straight year it's stayed above the Bank of Japan’s 2% target.

While that’s technically lower than February’s 3.7%, core-core inflation (which strips out fresh food and energy) rose to 2.9% from 2.6%.

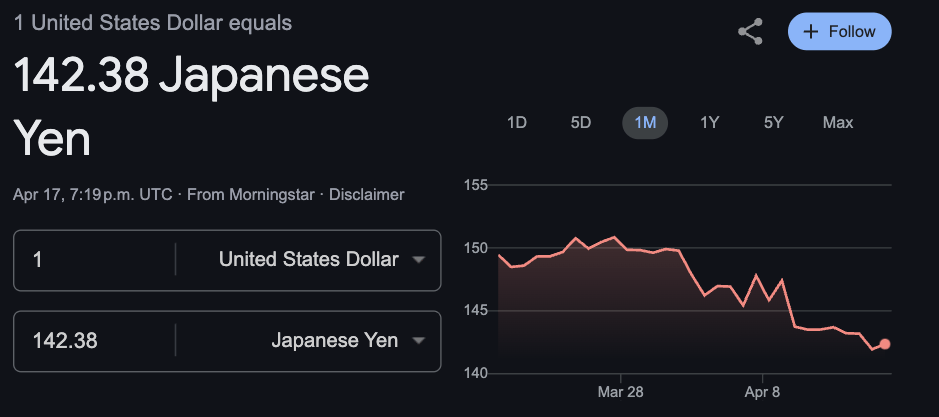

👉️ Translation for traders: The BOJ is facing pressure to hike rates—but tariffs from the U.S. could put the brakes on that.

Japan is still in trade talks with the U.S. after Trump hit them with 25% tariffs on auto imports and metals in early April.

While he suspended the reciprocal 24% tariff for 90 days, the damage may already be done.

Nomura now expects only one rate hike by the BOJ before 2027—down from two.

The Japanese economy is expected to flatline.

Nomura forecasts near-zero GDP growth for Q3 of this year, and warns that inflation pressure could keep rising into 2026, even as wage growth lags.

This matters for FX traders.

If Japan can’t hike due to growth risks, the yen may remain weak—even as inflation stays hot. That’s a tricky combo, and one that makes the JPY a great pair to watch in sentiment-based setups.

STOCKS

🚀 Netflix Crushes

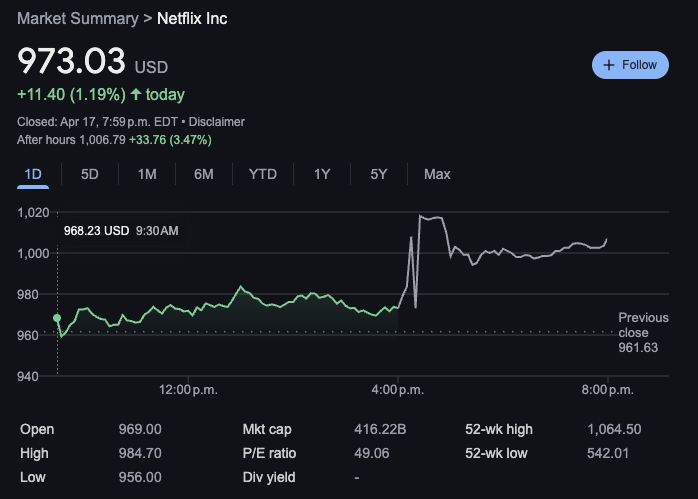

While Powell was being publicly dragged and Japan wrestled with 3.6% inflation, one stock was having the time of its life—Netflix.

Netflix surged Thursday after a strong earnings report, giving bulls the streaming confidence they desperately needed.

The stock popped 1% ahead of the report—and kept the momentum going.

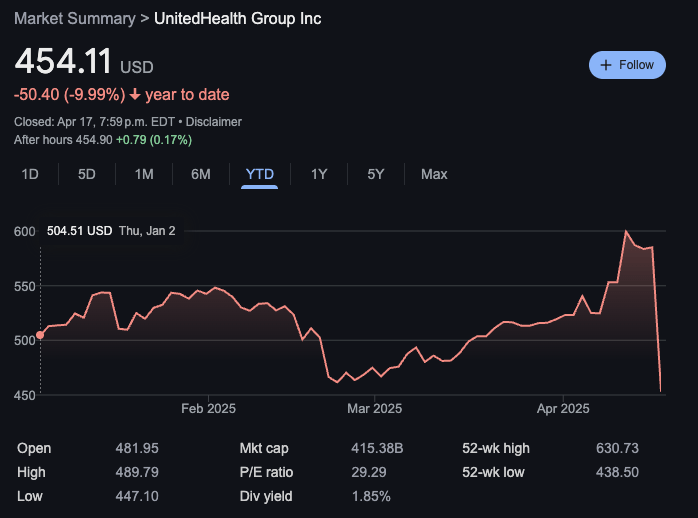

It was one of the few bright spots in a market otherwise weighed down by big losers. Nvidia slipped another 3% (after its brutal $5.5B chip export charge earlier in the week), and UnitedHealth dropped 22% after a rough earnings miss.

Since Trump’s April 2 tariff announcement, the index is down nearly 7%. The Dow and Nasdaq have each lost more than 7% too.

Investors seem stuck in limbo: half-watching Powell, half-watching Trump, and all waiting for clarity. But if there’s one thing we know about markets—it only takes one surprise to break the standstill.

PROP FIRMS

🤑 Friday Motivation

Wanted to update you guys on just my RISE payouts alone 💵. Trading changed my whole life and set me financially free! This is the best skill you will ever learn. In just the last 4 months I have received over $168,000 dollars from various prop firms just through RISE payouts

— TG-CAPITAL (@TylerG_Capital)

5:12 PM • Apr 16, 2025

🚀 Pre-Market Fuel

🍪 Munchy Memes

What do you think of today's edition? |

Share Pip Munch

Chances are you have some trading friends. Why don’t you be a pal, share Pip Munch and earn some goodies for it?

You currently have 0 referrals, only 1 away from receiving The Trading Plan That Helped Me Pass 4 $100,000 FTMO Challenges.

Or copy and paste this link to others: https://pipmunch.com/subscribe?ref=PLACEHOLDER