- Pip Munch

- Posts

- 🥊 Trump Versus Musk

🥊 Trump Versus Musk

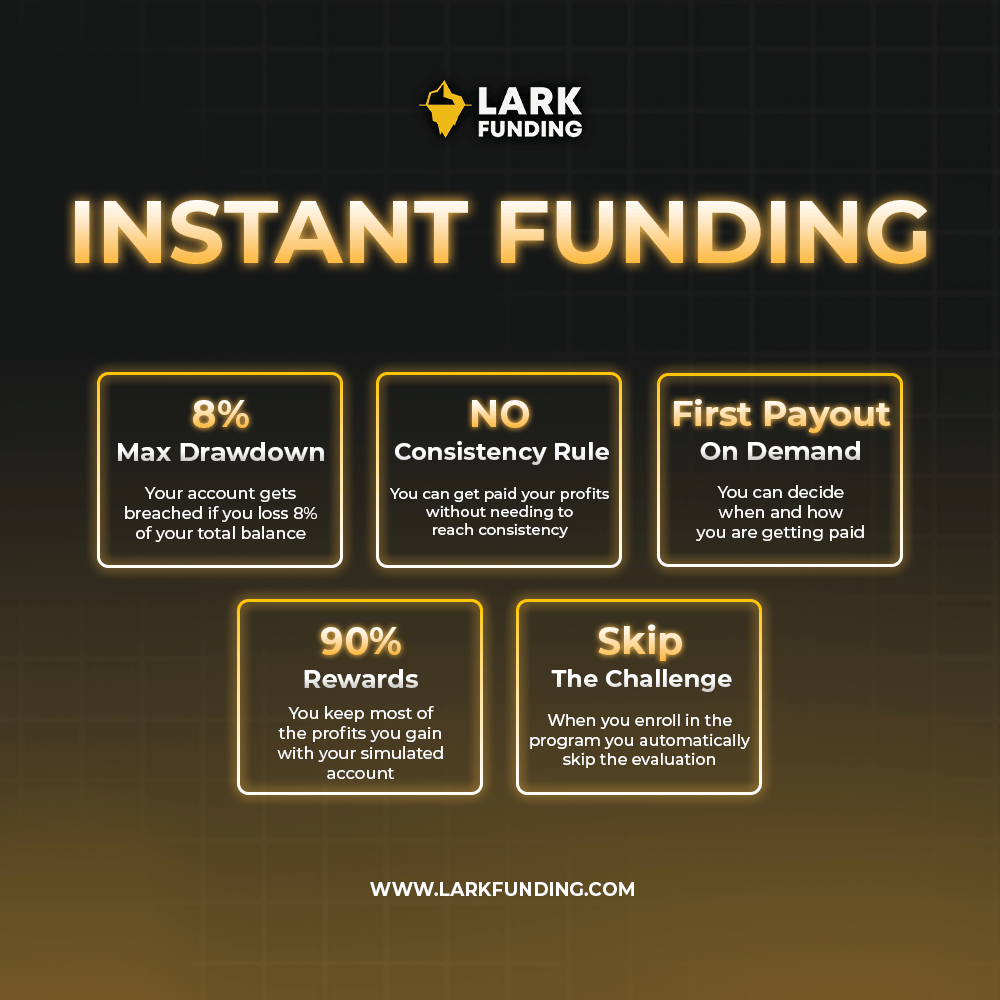

Looking for a prop firm that lets you skip the challenge and get paid fast? Meet Lark Funding’s Instant Funding — no evaluations, no consistency rules, and payouts in under 6 hours. You’ll keep up to 90% of your profits and start trading live on day one.

☕️ GM Munchers! It’s Friday — which means the only green I’m seeing is guac on my Chipotle bowl and not my portfolio.

On today’s menu:

🥊 Musk vs. Trump: Billionaire Beef Takes Out Tesla

📉 Bitcoin Breaks Below $102K—What Gives?

👀 Jobs Report Could Flip the Market Script

🚀 Breaking The Charts: Lululemon, Walmart & Costco

❓️ A New Prop Firm Model?

Yesterday’s numbers:

S&P 500 | 5,939 | -0.53% |

Nasdaq | 19,298 | -0.83% |

Dow Jones | 42,319 | -0.25% |

Bitcoin | $101,545 | -0.67% |

BREAKING NEWS

🥊 Musk vs. Trump: Billionaire Beef Takes Out Tesla

It was foretold.

— Middle Age Riot (@middleageriot)

7:12 PM • Jun 5, 2025

Washington’s favourite bromance is officially over—and absolutely nobody is surprised.

In one corner: Trump, furious over Elon’s opposition to his latest budget bill and the cost of EV subsidies.

In the other: Musk, calling Trump “ungrateful,” accusing him of hiding Epstein ties (👀), and threatening to decommission SpaceX’s Dragon spacecraft.

ELON MUSK: "Time to drop the really big bomb."

"Trump is in the Epstein files. That is the real reason they have not been made public."

— The Kobeissi Letter (@KobeissiLetter)

7:13 PM • Jun 5, 2025

Trump called Elon “CRAZY” and said cutting his government contracts would save “billions and billions.” Musk fired back with a “Go ahead, make my day,” like this was a cowboy standoff at the Mar-a-Lago corral.

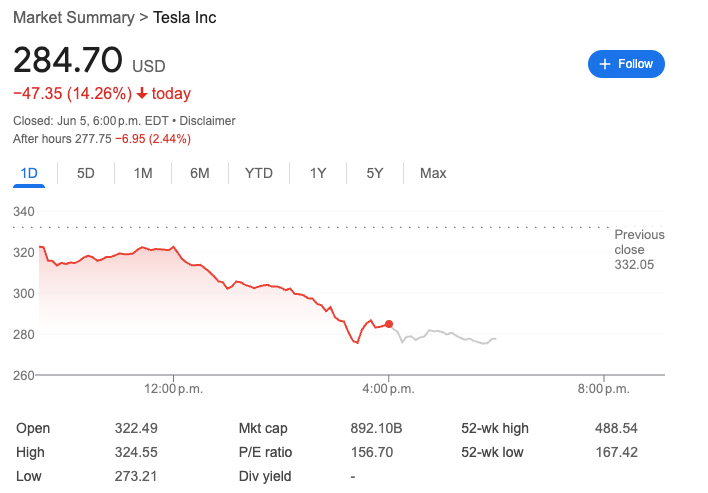

🧨 Result? Tesla dropped 14% as traders panicked about political retaliation, subsidy loss, and the escalating nuclear-level drama between two of the most market-moving humans on Earth.

Translation?

This isn't just internet slap-fighting—it’s a major sentiment shift. If Tesla starts losing favor with Washington, its valuation premium could shrink faster than my wife’s patience during a losing trade streak.

📉 What to watch:

EV subsidy updates

SpaceX contract news

Whether Trump logs back into Truth Social before Jerome Powell blinks

🛍️ Lululemon Just Did the Splits (and Not the Fun Kind)

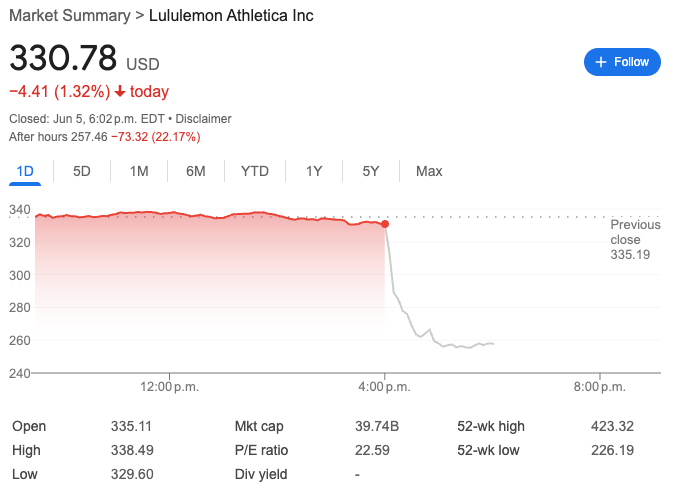

Lululemon crushed earnings (EPS $2.60 vs. $2.58 expected), but none of that mattered. The stock collapsed 23% after slashing full-year guidance, citing—you guessed it—Trump’s tariffs and a “dynamic macro environment.”

Retailers everywhere are scrambling:

Gap expects up to $150M in tariff-related hits

Abercrombie & Fitch slashed its outlook

Nike’s raising prices like it’s 2022

Lulu’s CFO said “strategic price increases” are coming soon, while CEO Calvin McDonald is “not happy” with U.S. growth and thinks consumers are turning cautious. (Same, Calvin. Same.)

Why traders care:

The retail sector is now a macro minefield.

Weak guidance + rising prices = demand slowdown = risk-off vibes.

Tariffs are back in play—and markets hate trade wars more than I hate when my wife sees my drawdown chart.

👀 Keep an eye on:

CPI next week (for inflation confirmation)

Any retailer not whining about tariffs (good luck finding one)

₿ Bitcoin Breaks Below $102K—What Gives?

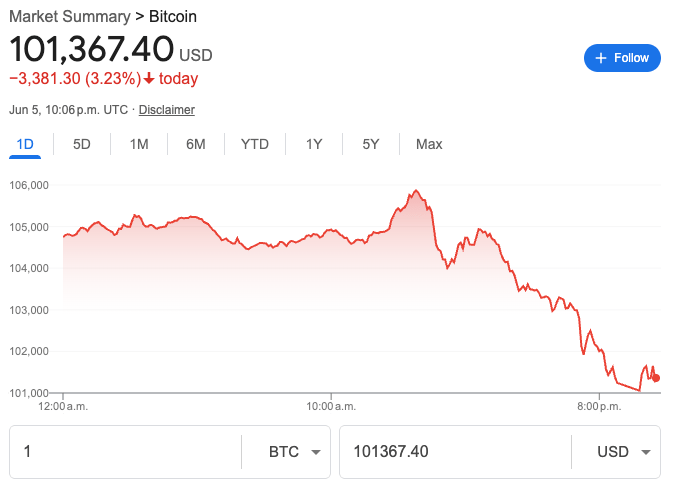

Bitcoin fell over 3% to $101,000 yesterday—but don’t let the red candles fool you. Under the surface, the “Bitcoin as global reserve currency” drumbeat is getting louder.

Coinbase CEO Brian Armstrong lit up X this week with a not-so-subtle warning:

If the electorate doesn't hold congress accountable to reducing the deficit, and start paying down the debt, Bitcoin is going to take over as reserve currency.

I love Bitcoin, but a strong America is also super important for the world. We need to get our finances under control.

— Brian Armstrong (@brian_armstrong)

12:44 AM • Jun 4, 2025

He followed up with:

“I love Bitcoin, but a strong America is also super important for the world. We need to get our finances under control.”

Translation? The $36.9 trillion national debt is no longer just a boring macro stat—it’s a flashing neon sign pointing traders toward alternative stores of value.

Even Elon reposted Armstrong’s take and warned that Congress is “making America bankrupt.”

🧵 Plain-English Play:

The worse Washington gets with money, the better Bitcoin looks.

Here’s what traders should keep an eye on:

BTC’s moves around jobs data and Treasury yields

Gold vs. Bitcoin correlation (they’re starting to flirt again)

Signs of institutional rotation into BTC, especially if D.C. keeps blowing out the deficit

In short: fiscal chaos = crypto tailwind.

BROUGHT TO YOU BY

Skip the Challenge. Get Paid Faster.

Tired of blowing evaluation accounts before you even get a shot at a payout?

With Lark Funding’s Instant Funding, you skip the challenge completely and start trading right away—with payouts on demand, 90% rewards, and no annoying consistency rules. Oh, and you’ll still get up to an 8% drawdown buffer.

That means more capital, less waiting, and real payouts—in under 6 hours.

No nonsense. No gimmicks. Just capital and freedom.

👉 Start now at larkfunding.com

💥 Use code JUNE15 for 15% off.

NEWS EVENTS

👀 Jobs Report Could Flip the Market Script

Today’s nonfarm payroll report (8:30am ET) might be the most market-moving event of the week—and that’s saying something after the Musk vs. Trump steel cage match.

Here’s the setup:

Consensus expects 125K new jobs in May (down from 177K in April).

But anything under 100K? That could freak the market out.

ADP already printed just 37K jobs—a 2-year low.

Translation?

If the numbers come in weak, the Fed may be forced to rethink its "higher for longer" stance. That means:

Lower yields 📉

Weaker dollar 📉

Risk-on rally (equities, crypto, gold) 📈

But if the jobs data beats? Traders might get slapped back into rate hike reality.

This is one of those “damned if you do, damned if you don’t” moments for the market—especially with sentiment already shaky and Powell ducking Trump’s daily roast sessions.

Set your alarms. The markets gonna move.

MARKET OVERVIEW

🍿 Tasty Movers & Shakers

$COST ( ▲ 2.44% ) Costco rang up $19.64 billion in May sales — a 6.8% YoY increase — but still managed to disappoint Wall Street’s insatiable appetite. The stock dipped after barely missing expectations. Guess selling 40-pound mayo buckets isn’t enough anymore.

$MSFT ( ▼ 2.24% ) Microsoft just hit a new all-time high — its first since July 2024 — and Satya’s smiling like he knows something we don’t. The CEO shouted out their OpenAI partnership, and the market basically responded with: “We love you. Never leave us.”

$AVGO ( ▼ 0.67% ) Broadcom crushed expectations with $15 billion in revenue and handed out a bullish forecast like candy. So what happened? The stock dropped in after-hours anyway. Because apparently doing everything right still isn’t enough when your name isn’t Nvidia.

$WMT ( ▲ 2.84% ) Walmart’s taking the skies — again. The retail giant is expanding drone delivery to three more states. Because nothing says “the future” like getting your toilet paper airlifted to the front yard.

PROP FIRMS

🤑 Friday Motivation

This trader just earned their 4th payout with us!

Anything is possible.

— larkfunding (@larkfunding)

4:14 PM • Jun 2, 2025

🚀 Pre-Market Fuel

🍪 Munchy Memes

BREAKING: Vladimir Putin has offered to negotiate a peace deal between President Trump and Elon Musk

— Whale Psychiatrist ™️ (@k_ovfefe2)

7:06 PM • Jun 5, 2025

Liberals trying to figure out whether to burn their Teslas or build Elon a statue:

— Brian Sauvé (@Brian_Sauve)

7:27 PM • Jun 5, 2025

There's only one guy who can help us now:

— Chris Bakke (@ChrisJBakke)

6:32 PM • Jun 5, 2025

When your two goats are fighting online

— Nelk Boys (@nelkboys)

4:40 PM • Jun 5, 2025

What do you think of today's edition? |

Share Pip Munch

Chances are you have some trading friends. Why don’t you be a pal, share Pip Munch and earn some goodies for it?

You currently have 0 referrals, only 1 away from receiving The Trading Plan That Helped Me Pass 4 $100,000 FTMO Challenges.

Or copy and paste this link to others: https://pipmunch.com/subscribe?ref=PLACEHOLDER