- Pip Munch

- Posts

- 📉 Uh-Oh

📉 Uh-Oh

Ready to take your first prop firm challenge? At Lark Funding, traders get paid in under 6 hours. No hidden rules. No delays. Just fast payouts, clean spreads, and up to 90% profit splits.

☕️ GM Munchers! Markets are down, morale is down, and my wife just sent me a “per my last text” at 7:12 am.

On today’s menu:

📉 Yields Pop. Stocks Drop. Bitcoin Laughs.

🤔 Microsoft, Amazon & Target Make Moves

💰️How To Make More Money Than Your Friends

❌ An Obvious Prop Firm Red Flag

😏 No More Taxes On Tips?

Yesterday’s numbers:

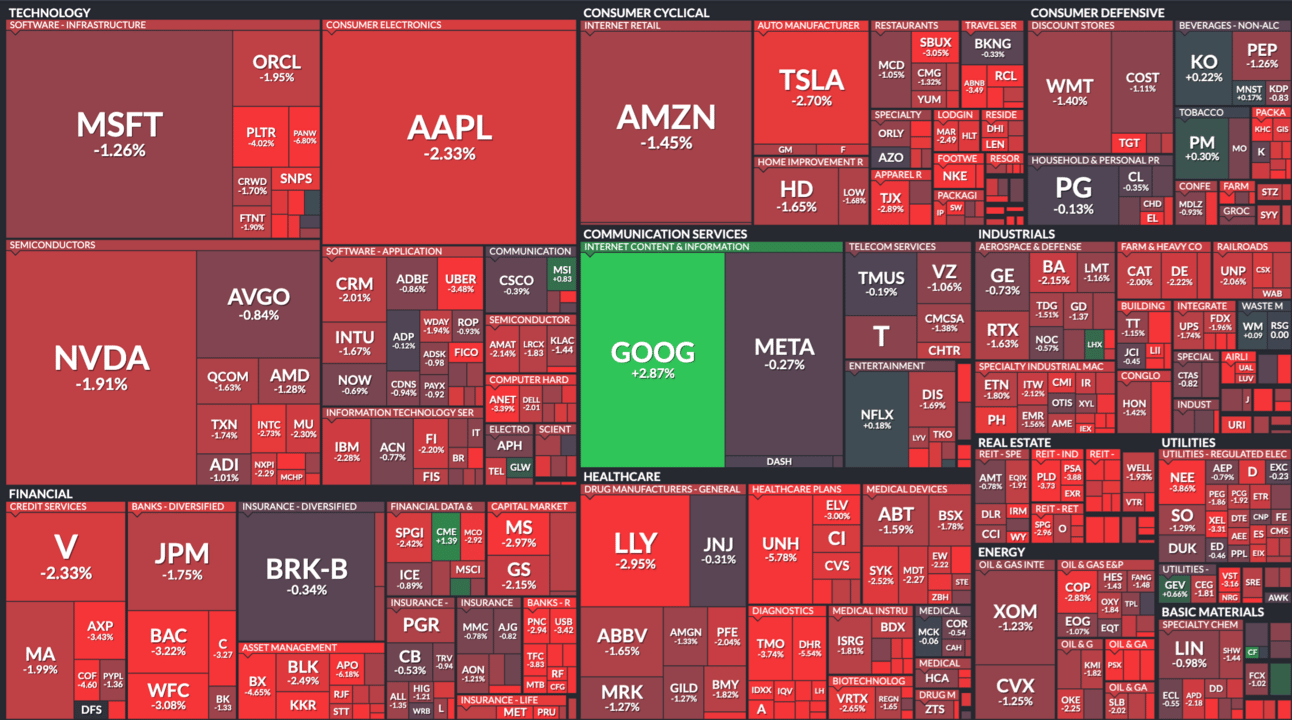

S&P 500 | 5,844 | -1.61% |

Nasdaq | 18,872 | -1.41% |

Dow Jones | 41,860 | -1.91% |

Bitcoin | $108,389 | +1.49% |

BREAKING NEWS

📉 Yields Pop. Stocks Drop. Bitcoin Laughs.

If you checked your portfolio yesterday and immediately closed the app — same. Here’s what blew up and what it means for your next trade:

📉 Stocks Took a Gut Punch

The Dow dropped 816 points. S&P 500 down -1.61%. Nasdaq off -1.41%.

Why? Bonds. (More on that below.)

Target fell 5.2% after slashing its full-year forecast

UnitedHealth lost 5.8% after a downgrade

Apple, Amazon dipped with rising yields

The party might not be over, but someone definitely turned the lights on. Markets have been hot lately — maybe too hot. A 13–18% run in a month? Yeah, digestion was coming.

What to watch:

→ VIX levels and key support zones.

→ SPX near 5,800.

→ Rotation into hard assets like gold and crypto.

💀 Bond Auction Flop = Panic Yields

📉 The S&P 500 instantly plunged over 70 points from the highs of the day

Why? The 20-year Treasury auction flopped with barely any buyers.

Yields spiked to 5.1%, signaling real stress in the credit markets.

— Michael Burry Stock Tracker ♟ (@burrytracker)

6:03 PM • May 21, 2025

The 20-year Treasury auction bombed like my attempt at convincing my wife Dogecoin was a “retirement plan.”

Yields soared to 5.1%, the highest since 2023. Why? No one wants to fund America’s shopping addiction.

The debt load is ballooning. And unlike Musk, Congress can’t launch us to Mars to escape it.

I don’t think any administration is capable to deal with our spending at this point.

— amit (@amitisinvesting)

5:58 PM • May 21, 2025

Translation:

→ Weak demand = rising yields

→ Rising yields = higher borrowing costs = bad for stocks

→ Long-term confidence in U.S. debt is cracking

🧵Plain-English Play: Bonds are really freaking traders out right now. As long as yields keep rising, piling into that risk-on trade is riskier than asking your girlfriend if she’s “actually mad or just hungry.”

₿ Bitcoin Hits a New High

BREAKING: #BITCOIN HAS HIT A NEW ALL TIME HIGH 🚀

— Bitcoin Magazine (@BitcoinMagazine)

3:05 PM • May 21, 2025

BTC tapped $109,693 before pulling back slightly.

Why?

Weak USD + rising yields = search for hard assets

$40B in ETF inflows this month alone

Macro chaos = BTC safe-haven play (yeah, we’re here now)

Add in some tariff relief, soft inflation, and shaky trust in sovereign debt, and you’ve got a perfect storm.

Next up for BTC:

→ $110K breakout watch

→ Keep tabs on yields — if they stay elevated and risk stays off, BTC could climb while stocks bleed

SPONSORED BY LARK FUNDING

🚀 The Best 1-Step Challenge Just Got 30% Cheaper

Lark Funding’s industry-leading 1-Step Challenge is now 30% off with code 1STEP30.

Smash a simple 10% target with 6% max drawdown.

✅ No Trailing Drawdown

✅ No Consistency Rules

✅ No News Restrictions

✅ Up To 90% Rewards

✅ Payouts In 6 Hours

✅ Accounts Start At Only $52.50

Just trade and get funded.

No gimmicks. No nonsense. Time to level up.

MARKET OVERVIEW

🍿 Tasty Movers & Shakers

$MSFT ( ▲ 1.18% ) Microsoft revealed that 394,000 Windows machines got hit with Lumma malware. Hackers swiped passwords, credit cards, bank logins… and yes, even crypto wallets. Clippy did not see that one coming.

$AMZN ( ▲ 1.6% ) CEO Andy Jassy says tariffs aren’t hurting consumer spending. Maybe because people are financing Chipotle with Klarna like it’s a used car.

$TGT ( ▲ 1.92% ) Target missed Q1 revenue and slashed its full-year outlook. They blamed weak consumer sentiment, tariff uncertainty, and backlash from rolling back their DEI program. Meanwhile, Amazon’s out here saying consumers are just fine.

$NVDA ( ▲ 0.68% ) Nvidia’s share in China just got chopped in half thanks to U.S. chip restrictions. CEO Jensen Huang warned the U.S. might lose the AI arms race if it keeps this up. Translation: stop nerfing my exports, please.

$NKE ( ▲ 1.59% ) Nike dropped over 4% after announcing price hikes on select sneakers starting June. Because nothing says “crushing inflation” like $210 Air Force 1s.

$GOOS ( ▲ 2.65% ) Apparently winter isn’t over—Canada Goose soared nearly 20% on strong earnings and shrugged off tariff fears, saying the impact is “minimal.” Target, you good?

TRADING TIPS

💰 How To Actually Use the News to Make More Money (Without Losing Your Mind)

Every day, we throw a lot at you.

Headlines. Charts. Market meltdowns. And the occasional joke about our wife asking us if we “really needed to place another gold trade at 3am.”

But underneath all that is one simple, crucial question:

“What do I actually do with this information?”

Today, we answer that — no jokes, no fluff (okay, some jokes). Because if you can learn to trade the news like a pro, you can stop getting faked out and start printing.

🧠 First, Understand This: You’re Not Trading Assets — You’re Trading Sentiment

You might think you’re trading EUR/USD or Bitcoin or gold.

You’re not.

You’re trading how the market feels about those things.

And that mood — aka risk sentiment — shifts based on headlines, central bank whispers, political chaos, and sometimes just vibes. If you want to make money, ask:

Are people feeling optimistic and piling into risk?

Or are they spooked and running to safe havens?

Here’s your cheat sheet:

Mood | Risk-On Assets | Risk-Off Assets |

|---|---|---|

🟢 Optimistic | NASDAQ, AUD, BTC, equities | ❌ Don’t touch these |

🔴 Nervous | USD, JPY, CHF, bonds, gold | ✅ These become your besties |

🔍 How to Actually Trade the News

Most traders read a headline and either:

Panic and overtrade.

Ignore it and wonder why their setup failed.

Here’s what smart traders do instead:

✅ Step 1: Ask “What happened?”

Is this a rate cut? War risk? New tariff? CPI print?

✅ Step 2: Interpret the impact

How does it shift risk sentiment? Is this bullish or bearish for risk assets?

✅ Step 3: Map the reaction chain

Example:

Surprise rate cut → lower USD → higher gold → tech stocks rally → VIX drops

✅ Step 4: Look for confirmation

Don’t ape in after the first candle. Wait for alignment across sentiment, price action, and volume.

🧪 Real Talk: This Is Exactly How We Played It

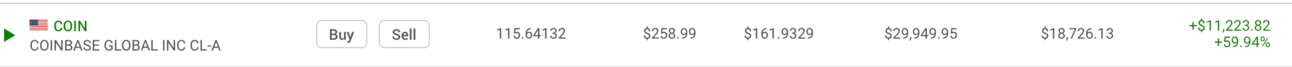

We told you for months that Trump’s tariff talk was mostly noise — a negotiation tactic. While other traders panic-sold anything with China exposure, we were loading up on Coinbase.

Why?

Because we believed risk sentiment would bounce back.

Result? $COIN is up 60% since we called it.

We weren’t being reckless. We had a thesis. We had confirmation. We had sentiment on our side.

🧵 TL;DR: Your 4-Question Framework

Use this lens every time you read our emails:

What just happened?

How does this shift sentiment?

Which assets benefit from that shift?

Is there confirmation in price yet?

Read the news like a sniper, not a slot machine addict.

🤝 We’ll Keep Doing the Heavy Lifting

You don’t need to read the Wall Street Journal in your underwear at 5am. Just open Pip Munch and ask yourself:

“Is the market feeling risky or scared?”

That one question will make you a better trader than 90% of your Telegram group.

And no, you don’t need another indicator. You need a better read on vibes.

PROP FIRMS

🤑 Thursday Motivation

Success Story from India!

On May 12th, 2025, a skilled trader from India demonstrated exceptional trading acumen, earning a significant $12,491.18 Performance Reward with FundedNext.

We are dedicated to supporting and rewarding ambitious traders.

Ready to take your trading

— FundedNext (@FundedNext)

4:47 PM • May 15, 2025

🚀 Pre-Market Fuel

🍪 Munchy Memes

People who bought bitcoin at $75K last month

— The ₿itcoin Therapist (@TheBTCTherapist)

4:28 PM • May 21, 2025

bitcoin 109K

calming down bro who sold at 72K last month :

— naiive (@naiivememe)

2:53 PM • May 21, 2025

What do you think of today's edition? |

Share Pip Munch

Chances are you have some trading friends. Why don’t you be a pal, share Pip Munch and earn some goodies for it?

You currently have 0 referrals, only 1 away from receiving The Trading Plan That Helped Me Pass 4 $100,000 FTMO Challenges.

Or copy and paste this link to others: https://pipmunch.com/subscribe?ref=PLACEHOLDER