- Pip Munch

- Posts

- 💀 USD Breaks Down. Hard.

💀 USD Breaks Down. Hard.

Want to trade without risking your own cash? Lark Funding gives you simulated capital to trade—plus up to 90% profit splits, no hidden rules, and instant payouts.

Use code JUNE15 for 15% off + a 125% refund on your next challenge.

☕️ GM Munchers! It’s Friday— the one day a week traders get to decide whether they’re celebrating their gains or crying into a Chipotle bowl about Trump’s latest tweets.

On today’s menu:

📉 The US Dollar Is Crashing

😢 GameStop Gets Destroyed

🤑 A $6,725 Prop Firm Payout

🚀 Platinum Just Went Parabolic

💳️ Coinbase Launches A Credit Card

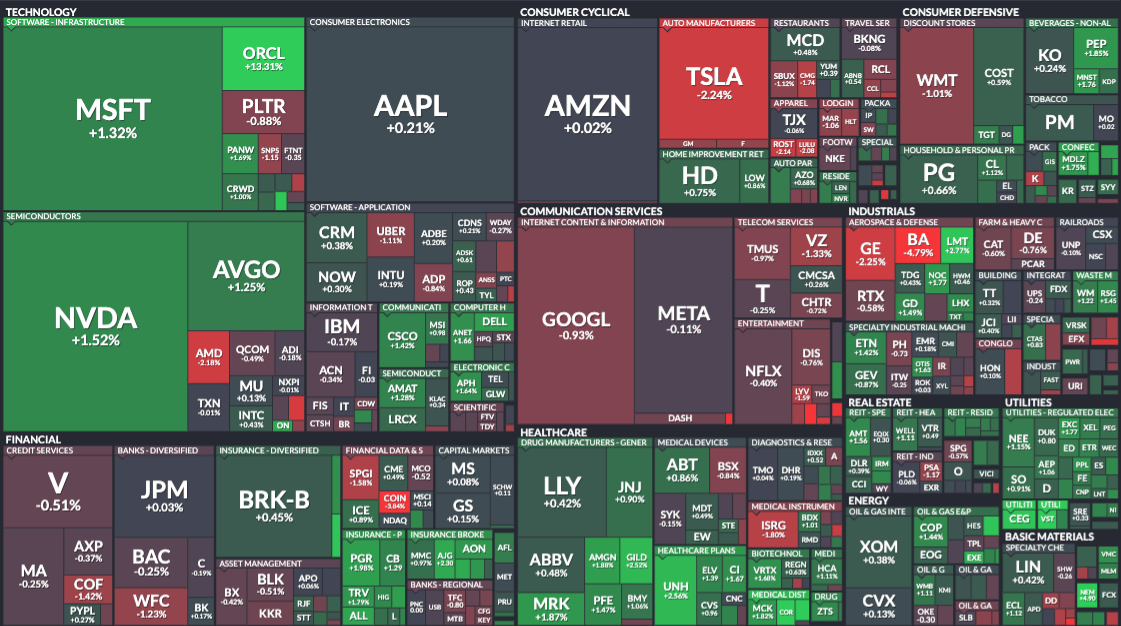

Yesterday’s numbers:

S&P 500 | 6,045 | +0.38% |

Nasdaq | 19,662 | +0.24% |

Dow Jones | 42,967 | +0.24% |

Bitcoin | $106,000 | -2.35% |

BREAKING NEWS

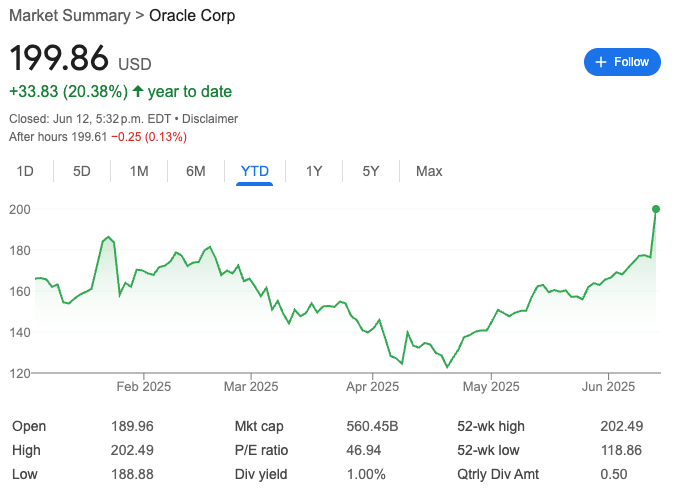

☕ Oracle Lifts Markets (And Our Spirits)

Stocks closed green yesterday—and for once, it wasn’t because someone at the Fed blinked. Oracle led the charge after reporting a cloud-crushing earnings beat.

Shares soared 13% after CEO Safra Catz said 2026 revenue should jump 70% thanks to AI demand. No word on whether the robots will be doing their taxes too.

May’s Producer Price Index (PPI) also helped. It rose just 0.1%, signaling inflation remains on a leash. Translation? The economy is stable-ish, rates may pause, and we all might be able to afford eggs again.

🧠 Trader Takeaway:

• Risk-on sentiment remains intact

• Big Tech continues to lead

• PPI + earnings beats = equities love it

💀 USD Breaks Down. Hard.

BREAKING 🚨: U.S. Dollar

$DXY could be headed for its lowest closing price in more than 3 years 👀😱

— Barchart (@Barchart)

2:53 AM • Jun 12, 2025

The U.S. dollar had a full-blown identity crisis yesterday. The DXY dropped 0.7%, pushing its year-to-date losses to almost 10%. That's not a typo. The last time the dollar was this weak, people still used Facebook.

Fueling the plunge?

Fears of a U.S.-Iran war are heating up. Trump’s tone toward Tehran has turned from “deal vibes” to “get ready for conflict.” The Pentagon has already pulled nonessential staff from multiple embassies in the Middle East.

🧠 Trader Takeaway:

• Safe havens (gold, yen) are back in play

• USD/CAD broke down—watch oil and CAD strength

• If DXY closes below 98.90, strap in

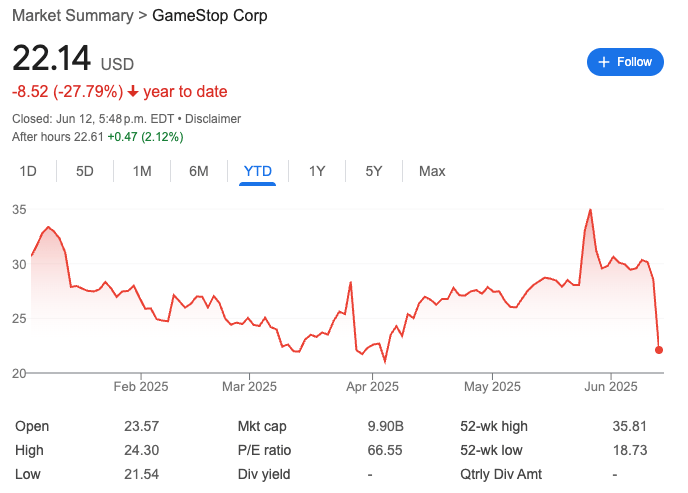

🎮 GameStop’s Bitcoin Play Goes… Well, You Know

GameStop just hit itself with a 22% drawdown after announcing plans to raise $1.75B in debt to buy Bitcoin. Yes, seriously.

The company wants to be the next MicroStrategy, but instead of software, they sell used copies of Call of Duty: Black Ops II.

Wall Street wasn’t amused. Shares fell like a rogue NPC off a cliff. Gamers are buying digital, revenue is falling, and now they’re betting the balance sheet on BTC. Bold move, Cohen.

🧠 Trader Takeaway:

• GME is now a degen macro bet, not a retailer

• Sentiment is crumbling—meme stock bulls, beware

• BTC exposure ≠ guaranteed pump (especially when you do it with debt)

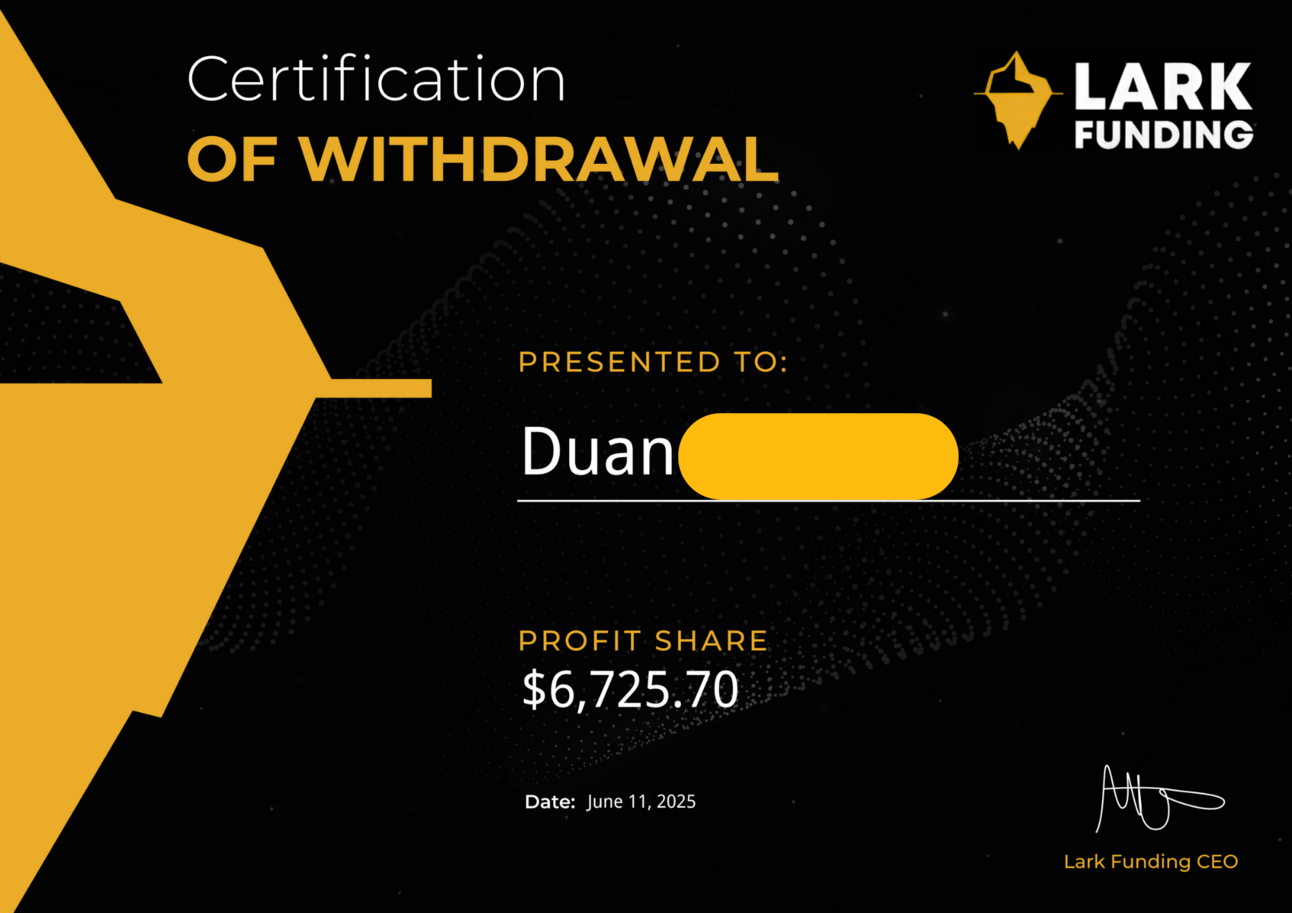

BROUGHT TO YOU BY

🤑 He Turned a Challenge Account Into a $6,725.70 Payout

One of our readers, Duan, just walked away with a $6,725.70 profit share from his simulated funded account at Lark Funding.

No payout delays.

No weird consistency rules.

Just a clean setup built for traders who can perform under pressure.

Here’s how it works: Lark Funding provides simulated funded accounts, where traders can prove their skills and earn a share of the simulated profits—without risking their own money.

If you’ve never taken a prop firm challenge before, this might feel new. But for traders looking to level up without draining their personal account, it’s quickly becoming the smartest play on the board.

👉 LarkFunding.com — take a look and see if you’re ready to turn performance into payout.

SENTIMENT

🤣 Trump Called Powell A Numbskull

President Trump calls Fed Chair Powell a "numbskull" for not cutting interest rates.

— Brew Markets (@brewmarkets)

4:26 PM • Jun 12, 2025

Donald Trump just called Fed Chair Jerome Powell a “numbskull” for not cutting interest rates. (We’ll let you decide if that’s economics or WWE promo.)

But here’s the real tea: this isn’t just political noise—it’s market-moving stuff.

Why do interest rates matter so much?

Think of them as the price of money.

When rates go up: borrowing costs rise → companies spend less, stocks drop, USD strengthens.

When rates go down: borrowing gets cheaper → stocks and crypto rip, the dollar weakens, and my wife finally lets me refinance the kitchen.

So why does Trump want a cut?

Simple—lower rates =

✅ Cheaper debt for businesses (and the U.S. government)

✅ A weaker dollar (helps exports, hurts inflation-fighting)

✅ A stock market boost (great for campaigns…and portfolios)

He says Powell is hurting Americans by keeping rates “too high for too long.”

Here’s what to watch next:

Fed meetings → Will Powell respond?

Rate-sensitive assets → Gold, tech stocks, crypto

USD pairs → If the Fed does cut, DXY could drop even more

Bottom line?

Whether Powell listens or not, this tension adds fuel to the “rate cut rally” hopes. Just don’t call your boss a numbskull and expect a raise.

MARKET OVERVIEW

🍿 Tasty Movers & Shakers

$BA ( ▼ 0.82% ) Boeing fell 5% after tragedy struck. An Air India Dreamliner went down, killing 241 people. Only one person survived. The market reaction was swift—and brutal. Safety concerns like this don’t just hit headlines, they hit Boeing’s bottom line.

$SHOP ( ▼ 4.14% ) Shopify slipped 4% after Google Cloud glitched out harder than me trying to explain options to my wife. The outage also hit OpenAI and Cloudflare, but Shopify took it personally. When your backend vanishes mid-checkout, Wall Street notices.

$CHYM ( ▼ 7.68% ) Chime popped 37% on IPO day, closing at $37. It’s now worth $11.6B and raised $700M in the process. That’s not just a win—it’s a standing ovation in fintech land. Can it hold? Or will this chart look like Robinhood’s by next week?

$TRZ.A.TSX ( 0.0% ) Air Transat nosedived 11% after reporting a $22.9M quarterly loss. That’s less bad than the $54M they torched last year, so…yay? Still, flights from Canada to the U.S. are down 13% for December, so they’re banking on Europeans to save the winter. Good luck with that.

$COIN ( ▼ 2.88% ) Coinbase’s CEO basically told the U.S. government: “Keep spending like this, and Bitcoin’s taking your job.” He’s not wrong. There’s only 21 million BTC, and most of us are still busy buying altcoins that end in “-inu.”

PROP FIRMS

🤑 Friday Motivation

I lost, I broke, I doubted myself a thousand times. But I kept going. Today I’m FTMO funded, not because I’m special, but because I refused to quit. This is my return. Stronger. Smarter. Focused.

— Yusuf Mert Çullu (@yusufmertcullu)

1:46 PM • Jun 12, 2025

🚀 Pre-Market Fuel

🍪 Munchy Memes

People that locked in a 30-year fixed mortgage at 2.69% in 2021

— Evan (@StockMKTNewz)

6:07 PM • May 19, 2025

What do you think of today's edition? |

Share Pip Munch

Chances are you have some trading friends. Why don’t you be a pal, share Pip Munch and earn some goodies for it?

You currently have 0 referrals, only 1 away from receiving The Trading Plan That Helped Me Pass 4 $100,000 FTMO Challenges.

Or copy and paste this link to others: https://pipmunch.com/subscribe?ref=PLACEHOLDER