- Pip Munch

- Posts

- 📉 Stock Pick Update

📉 Stock Pick Update

☕️ GM Munchers,

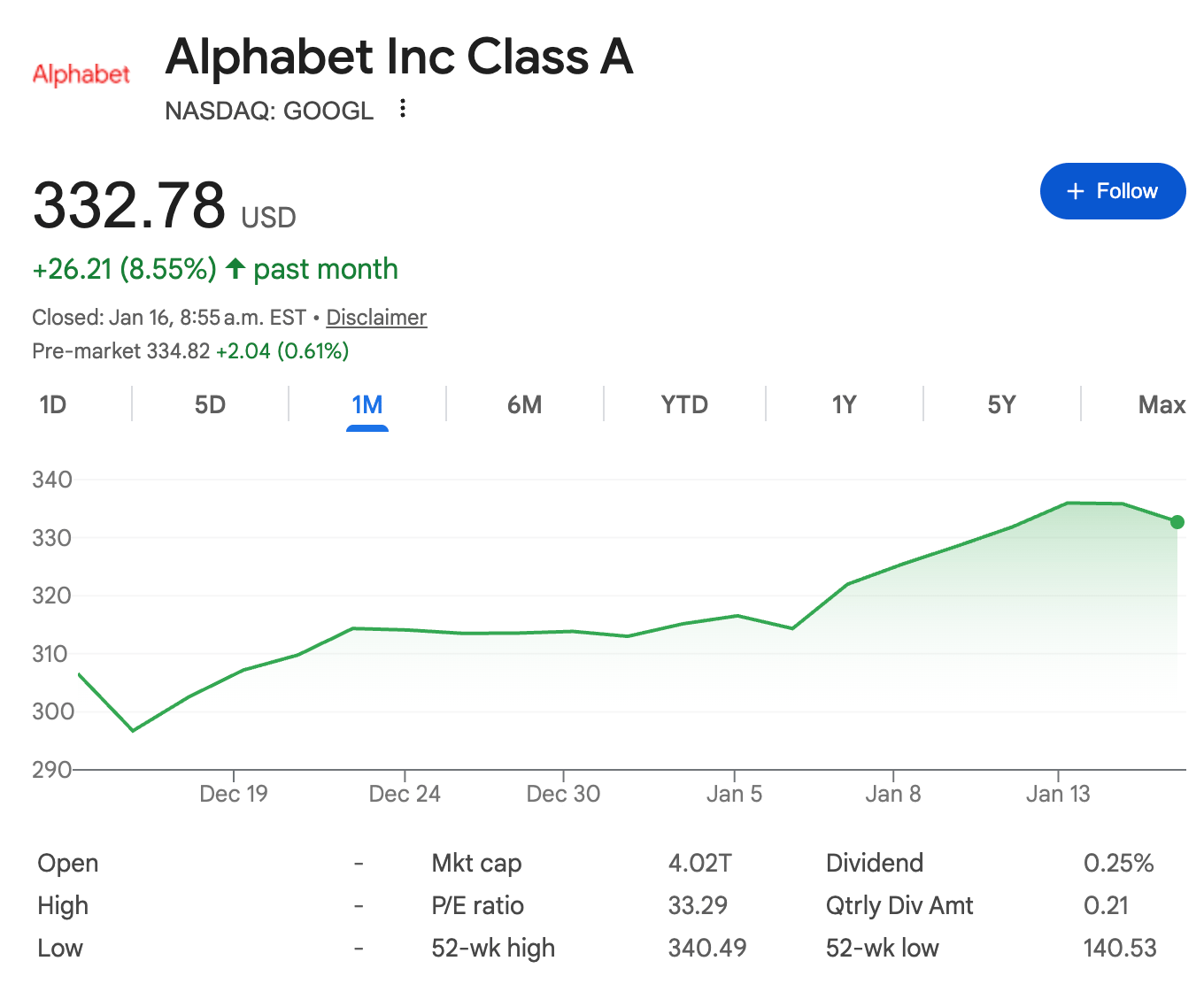

Two weeks ago, we launched the Pip Munch Portfolio and picked Google at $314 as our first long-term hold. The internet collectively yawned, a few people called us idiots for not buying immediately, and Warren Buffett probably didn't notice.

Today? Google's sitting at $332. Up 5.7% in two weeks.

Before you start planning your yacht purchase, let's pump the brakes. This is a vanity metric. We're not picking stocks because we think they'll rip 6% in fourteen days—we're picking them because we think they'll compound massively over 20 years. But still, being green out the gate feels better than starting in the red while your wife asks why you're stress-eating cashews at 9 AM.

😏 Portfolio Update: The Good, The Meh, and The "Still Waiting"

Our only red position two weeks ago? That 2025 Bitcoin entry that was down -8.34% and making us question our life choices.

Today? Down only -2.64%. Still red, but trending in the right direction like a trader who finally stopped revenge trading after lunch.

Activity Report: We Bought 7 Shares

Not so exciting stuff: we added 7 shares of $ZQQ (our Canadian dollar-hedged Nasdaq ETF) for roughly $1,200. It’s our main holding at 48% of our portfolio.

That's it. No wild gambling. No options YOLO. Just boring, systematic accumulation that would make a financial advisor weep tears of joy.

⏰ Google: Still Watching, Still Waiting

We told you two weeks ago we weren't buying Google at all-time highs. We wanted a pullback to $300 for better risk-reward.

The stock promptly ignored us and ripped to $332.

Our response? Absolutely nothing. Zero panic. Zero FOMO. Just watching like a hawk and reminding ourselves that missing 5% of a move is fine if it means catching the next 40% with lower risk.

Could we have made $1,260 if we'd bought 70 shares at $314? Sure. But that's not the game we're playing. We're building wealth over decades, not bragging rights over lattes.

If Google dips back toward $300 on some random macro scare (tariffs, Fed drama, alien invasion rumors), we're ready. Until then, we're doing the hardest thing in trading: nothing.

🚀 Big Picture: Markets Are Ignoring the Chaos (For Now)

Here's what should be freaking everyone out but somehow isn't:

Venezuela tensions: The market's acting like this is background noise

Greenland acquisition rumours: 20% odds the US does something wild here, yet nobody's pricing in risk

Supreme Court tariff decision: Pushed to June, which ironically became a bullish catalyst because uncertainty got kicked down the road

Translation? Risk-on is alive. Tech's grinding higher. And everyone's collectively decided to worry about geopolitics later.

This won't last forever. But for now? Enjoy the melt-up while keeping one hand on the exit.

✅ What's Next: Monthly Picks + Bi-Weekly Updates

Here's the cadence going forward:

Monthly: One new stock pick with full analysis (fundamentals, technicals, macro, sentiment)

Bi-weekly (like this one): Portfolio updates, position changes, and brutally honest performance tracking

We're not hiding losers. We're not cherry-picking winners. You'll see every trade, every mistake, and every "why the hell did we do that?" moment in real-time.

January's pick was Google. February's coming soon. Until then, we're accumulating boring ETFs and waiting for better entries like patient investors who've learned the hard way that chasing all-time highs is how you fund therapists, not retirements.

Stay sharp, own assets, and remember: two-week returns are noise. Two-decade returns are wealth.

— Matthew, Pip Munch

P.S. Still trying to make money in trading? Stop trying to grow your small $500 account and focus on prop firms. For that same $500, you can start earning 90% of what you make on a $100,000 simulated account. Learn More Here →

What do you think of today's edition? |

Share Pip Munch

Chances are you have some trading friends. Why don’t you be a pal, share Pip Munch and earn some goodies for it?

You currently have 0 referrals, only 1 away from receiving The Trading Plan That Helped Me Pass 4 $100,000 FTMO Challenges.

Or copy and paste this link to others: https://pipmunch.com/subscribe?ref=PLACEHOLDER